3 critical long-term care insurance questions seniors should be asking now

In today's economy, seniors should be contemplating the answers to these three long-term care insurance questions.

In today's economy, seniors should be contemplating the answers to these three long-term care insurance questions.

In the evolving economic climate of May 2025, here are three ways to safely invest in gold right now.

Think a $25,000 annuity won't move the needle? Here's what it pays (and whether it's worth your investment).

If you're going to invest in precious metals, knowing what the gold-silver ratio is could come in handy.

Both options allow seniors to tap their home equity, but the right one depends on a range of factors.

With interest rates high and the prospects of relief low, here are three considerations borrowers should make now.

The price of gold is declining again. Here's how investors should (and shouldn't) respond to that development.

Payday loans can spiral fast, especially when fees stack up. Here's what to know if things start to go sideways.

Borrowing money from your home could be made easier for those owners with 100% home equity. Here's what that means.

Thinking about buying an annuity? Here's what to know about your principal and what could put it at risk.

There are unique benefits and downsides for retirees considering annuities in today's economic climate.

Knowing why home equity products have different interest rates can help you make smarter borrowing decisions.

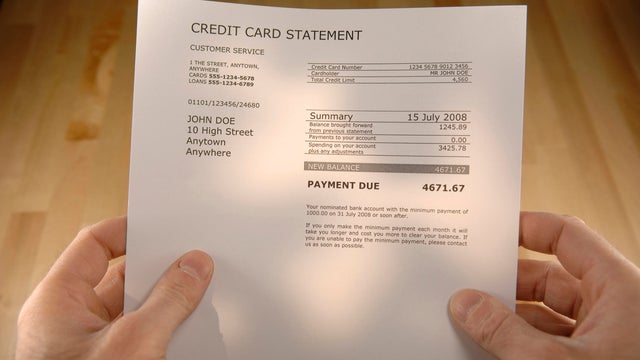

Thinking about applying for credit card debt forgiveness in today's economy? Start by inspecting these three items.

Gold's price pullback may signal an opportunity. Here's how investors can take advantage before prices rebound.

HELOC interest rates have changed substantially in recent months. Here's what to know at this point in 2025.

Our website uses cookies to improve your experience. Learn more